How to Defend a Lawsuit from Velocity Investments, LLC

Confronting a lawsuit can be a challenging experience, especially when it comes from a debt buyer like Velocity Investments, LLC in Texas, a company you might not be familiar with. Understanding your legal rights and options is essential when facing such a situation. Our team of Texas Debt Defense Attorneys offer insights into dealing with Velocity Investments, LLC and strategies for handling a lawsuit from them.

Is Velocity Investments, LLC. Legit?

Yes, Velocity Investments, LLC. is a legitimate company. Velocity Investments, LLC is a debt buyer that engages in the business of buying charged-off and defaulted consumer debts from creditors. Velocity Investments, LLC is not a law firm. They specialize in buying debts from creditors and then pursuing collection actions, including litigation against consumers in Texas.

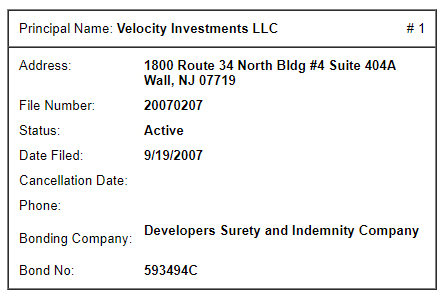

Velocity Investments, LLC is a Registered Debt Collector

Velocity Investments, LLC operates as a debt buyer and is registered in Texas. In Texas, while there is no specific licensing requirement for debt collectors, a surety bond filed with the Texas Secretary of State is mandatory. Velocity Investments, LLC has a debt collection bond on file with the Texas Secretary of State issued by Developers Surety and Indemnity Company.

What Kinds of Debts Does Velocity Investments, LLC Collect?

Velocity Investments, LLC primarily deals with purchased debts from original creditors. Their portfolio typically includes debts from credit cards, personal loans, and other consumer financial products. By buying these debts, they assume the role of the creditor and initiate collection efforts, which may include legal action against consumers.

How to Defend a Lawsuit from Velocity Investments, LLC

Responding to a Lawsuit from Velocity Investments, LLC If you find yourself targeted by a lawsuit from Velocity Investments, LLC for debt collection, it’s crucial to take prompt and strategic action:

- Do Not Overlook the Lawsuit: Ignoring it could lead to a default judgment, potentially resulting in bank garnishments, liens, or seizures.

- Consult an Experienced Debt Defense Lawyer: Our lawyers at Jaffer & Associates excel in helping Texans effectively handle collection cases, ensuring you understand your legal position, the authenticity of the debt, and potential defenses.

- Respond Timely to the Lawsuit: Failing to respond promptly might result in a default judgment. You have 14 days to respond if you were sued by Velocity Investments, LLC in a Justice of the Peace Court. Otherwise, you have 20 days from being served the lawsuit if the case was filed in a County of District Court in Texas.

- Consider Settlement or Legal Challenge: Depending on your situation, settling the lawsuit or contesting it in court are viable options. Settlements can be advantageous in reducing debt amounts and getting a manageable payment plan. Whereas challenging the lawsuit is suitable if there are flaws in the creditor’s case, such as incorrect debt amounts, expired statutes of limitations, mistaken identity, or identity theft.

- Challenge the Lawsuit’s Merits: Your lawyer can help identify any inaccuracies or errors in the lawsuit, such as incorrect debt amounts or mistaken identity. Uncovering these issues can be critical in defending against the lawsuit.

- Discovery and Getting a Dismissal:

One major element of defending the case is to verify if the creditor has all records necessary to prove up their claim. In debt collection lawsuits you or your attorney should request all credit card statements, bills of sales, and purchase and sales agreements to ensure that the party suing has the right to sue for the consumer debt. This happens in discovery during a lawsuit and can lead to a lawsuit being dismissed if done correctly. - Negotiate a Settlement: If Velocity Investment, LLC presents a strong case then negotiating for a lower settlement amount may be the wise approach. Often, settlements can be negotiated to amounts significantly lower than the original debt and payment plans can be arranged as well.

- Filing a Counterclaim:You may be able to file a counterclaim for violation of the Fair Debt Collection Practices “FDCPA” or the Fair Credit Reporting Act. This occurs if the creditor or debt buyer engages in practices or conduct prohibited under these federal consumer protection laws. An experienced attorney such as the attorneys at Jaffer & Associates look for all sorts of violations during the defense of your lawsuit.

How Much Does a Debt Defense Attorney Charge?

We at Jaffer & Associates charge a Flat Fee for your lawsuit defense based on the amount of the lawsuit. You can either pay upfront in full or we can provide you with a flexible payment plan.

SEE OUR PRICING